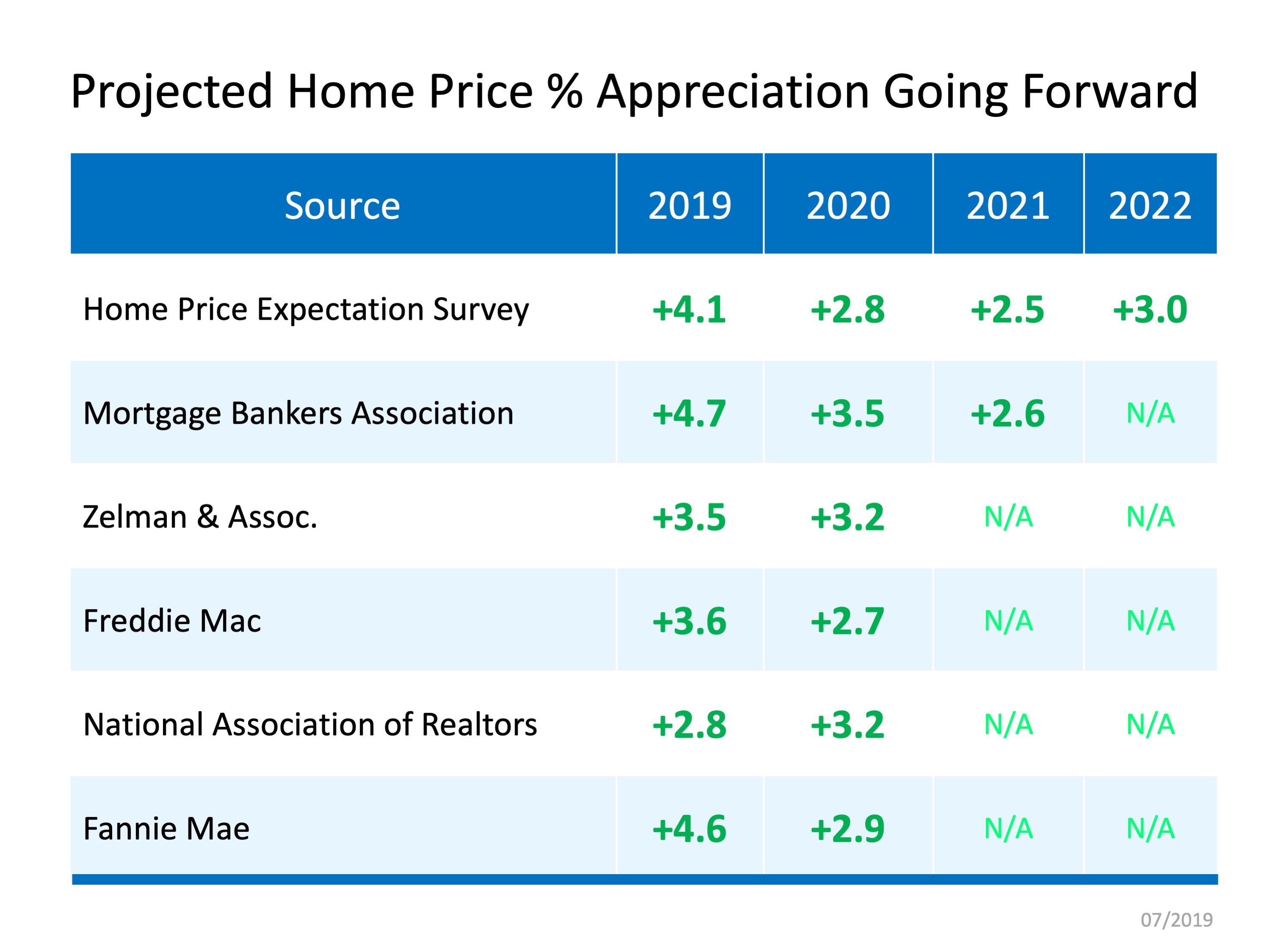

Questions continue to come up about where home prices will head throughout the rest of this year, as well as where they may be going over the few years beyond.

We’ve gathered current data from the industry’s most reliable sources to help answer these questions:

The Home Price Expectation Survey – A survey of over 100 market analysts, real estate experts, and economists conducted by Pulsenomics each quarter.

Mortgage Bankers Association (MBA) – As the leading advocate for the real estate finance industry, the MBA enables members to successfully deliver fair, sustainable, and responsible real estate financing within ever-changing business environments.

Zelman & Associates – The firm leverages unparalleled housing market expertise, extensive surveys of industry executives, and rigorous financial analysis to deliver proprietary research and advice to leading global institutional investors and senior-level company executives.

Freddie Mac – An organization whose mission is to provide liquidity, stability, and affordability to the U.S. housing market in all economic conditions extending to all communities from coast to coast.

The National Association of Realtors (NAR) – The largest association of real estate professionals in the world.

Fannie Mae – A leading source of financing for mortgage lenders, providing access to affordable mortgage financing in all markets.

Here’s the home price appreciation these experts are projecting over the next few years:

Bottom Line

Every source sees home prices continuing to appreciate, which is great news for the strength of the market. The increase is steepest throughout the rest of 2019, and prices should continue to rise as we move through 2020 and beyond.

![Home Prices Up 5.05% Across the Country [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/07/25072858/20190729-MEM-1046x1600.jpg)